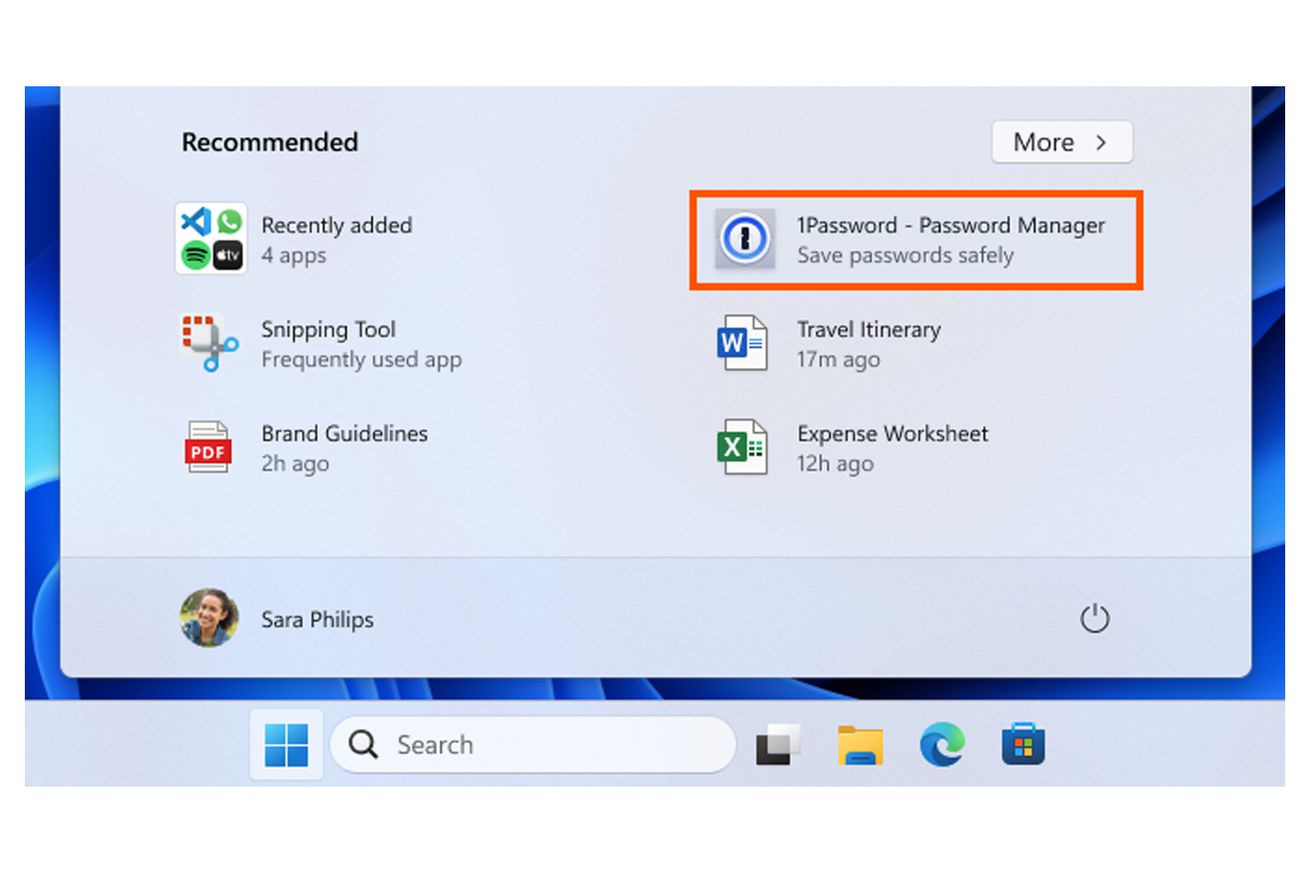

Microsoft is starting to enable ads inside the Start menu on Windows 11 for all users. After testing these briefly with Windows Insiders earlier this month, Microsoft has started to distribute update KB5036980 to Windows 11 users this week, which includes “recommendations” for apps from the Microsoft Store in the Start menu.

“The Recommended section of the Start menu will show some Microsoft Store apps,” says Microsoft in the update notes of its latest public Windows 11 release. “These apps come from a small set of curated developers.” The ads are designed to help Windows 11 users discover more apps, but will largely benefit the developers that Microsoft is trying to tempt into building more Windows apps.

Microsoft only started testing...