Technology companies spent part of the 2010s trying to convince us that we would want an 8K display one day.

In 2012, Sharp brought the first 8K TV prototype to the CES trade show in Las Vegas. In 2015, the first 8K TVs started selling in Japan for 16 million yen (about $133,034 at the time), and in 2018, Samsung released the first 8K TVs in the US, starting at a more reasonable $3,500. By 2016, the Video Electronics Standards Association (VESA) had a specification for supporting 8K (Display Port1.4), and the HDMI Forum followed suit (with HDMI 2.1). By 2017, Dell had an 8K computer monitor. In 2019, LG released the first 8K OLED TV, further pushing the industry's claim that 8K TVs were "the future."

A marketing image for 8K TVs that's (still) on LG's US website.

Credit:

LG

However, 8K never proved its necessity or practicality.

TV companies are quitting 8K

LG Display is no longer making 8K LCD or OLED panels, FlatpanelsHD reported today. Earlier this month, an LG Display representative told FlatpanelsHD that the panel supplier is “taking a comprehensive view of current display market trends and the trends within the 8K content ecosystem.”

“As our technical readiness is already complete, LG Display is fully prepared to respond immediately whenever the market and customers determine that the timing is right,” LG Display's representative said.

LG Electronics was the first and only company to sell 8K OLED TVs, starting with the 88-inch Z9 in 2019. In 2022, it lowered the price-of-entry for an 8K OLED TV by $7,000 by charging $13,000 for a 76.7-inch TV.

FlatpanelsHD cited anonymous sources who said that LG Electronics would no longer restock the 2024 QNED99T, which is the last LCD 8K TV that it released.

LG's 8K abandonment follows other brands distancing themselves from 8K. TCL, which released its last 8K TV in 2021, said in 2023 that it wasn’t making more 8K TVs due to low demand. Sony discontinued its last 8K TVs in April and is unlikely to return to the market, as it plans to sell the majority ownership of its Bravia TVs to TCL.

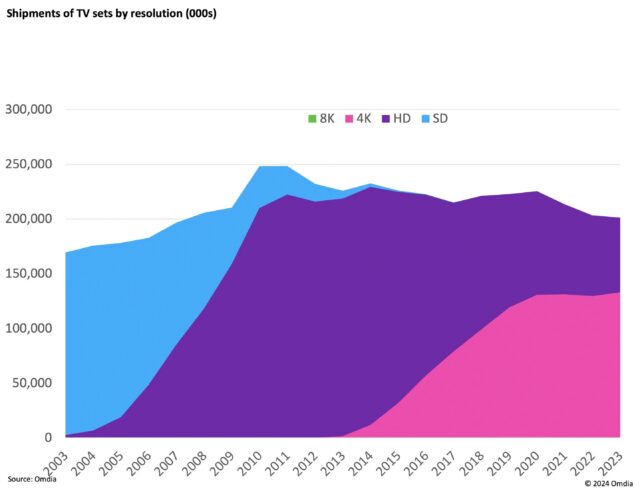

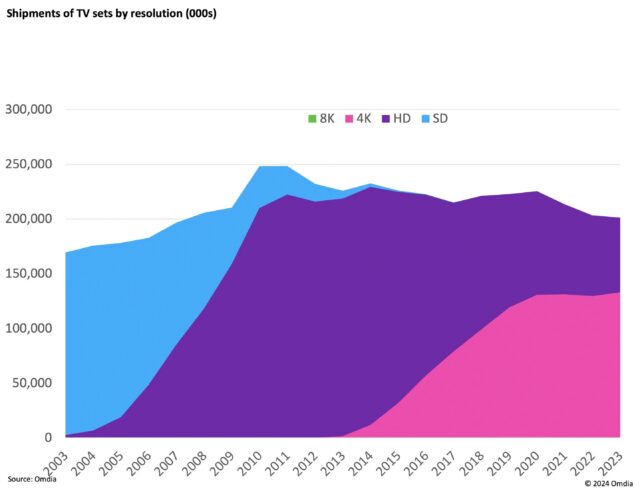

The tech industry tried to convince people that the 8K living room was coming soon. But since the 2010s, people have mostly adopted 4K. In September 2024, research firm Omdia reported that there were “nearly 1 billion 4K TVs currently in use.” In comparison, 1.6 million 8K TVs had been sold since 2015, Paul Gray, Omdia’s TV and video technology analyst, said, noting that 8K TV sales peaked in 2022.

Omdia's 2024 data shows demand shifting toward 4K TVs.

Credit:

Omdia

That helps explain why membership at the 8K Association, launched by stakeholders Samsung, TCL, Hisense, and panel maker AU Optronics in 2019, is dwindling. As of this writing, the group’s membership page lists 16 companies, including just two TV manufacturers (Samsung and Panasonic). Membership no longer includes any major TV panel suppliers. At the end of 2022, the 8K Association had 33 members, per an archived version of the nonprofit’s online membership page via the Internet Archive’s Wayback Machine. Upon its debut, the 8K Association said that its goals include “promoting 8K TVs and 8K content to consumers and professionals” and “helping secure 8K native content for members."

Where 8K failed

It wasn't hard to predict that 8K TVs wouldn't take off. In addition to being too expensive for many households, there's been virtually zero native 8K content available to make investing in an 8K display worthwhile. An ongoing lack of content was also easy to predict, given that there's still a dearth of 4K content, and many streaming, broadcasting, and gaming users still rely on 1920×1080 resolution.

Gaming was supposed to be one of the best drivers for 8K adoption. The PlayStation 5 (PS5) Pro was originally marketed as supporting 8K. Sony officially rescinded that promise in June 2024, though. Due to bandwidth limitations, the PS5 Pro could only deliver 8K via Display Stream Compression over HDMI 2.1, making the feature incompatible with some 8K TVs.

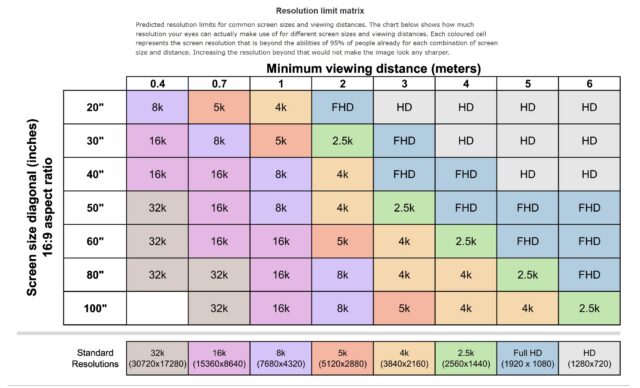

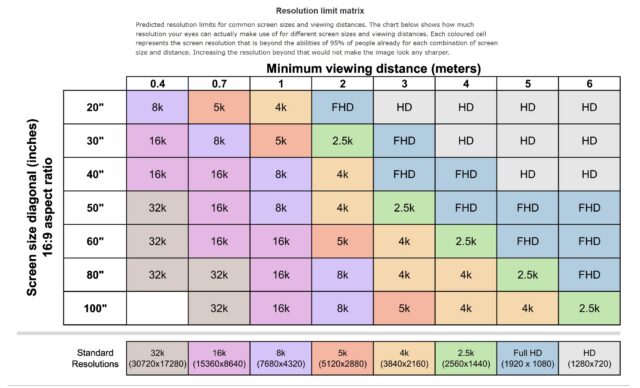

There’s also the crucial question of whether people would even notice the difference between 4K and 8K. Science suggests that you could, but in limited situations.

The University of Cambridge’s display resolution calculator, which is based on a study from researchers at the university’s Department of Computer Science and Technology and Meta, funded by Meta, and published in Nature in October, suggests that your eyes can only make use of 8K resolution on a 50-inch screen if you’re viewing it from a distance of 1 meter (3.3 feet) or less. Similarly, you would have to be sitting pretty close (2–3 meters/6.6–9.8 feet) to an 80-inch or 100-inch TV for 8K resolution to be beneficial. The findings are similar to those from RTINGs.com.

The University of Cambridge's resolution limit matrix.

Credit:

Computer Laboratory, University of Cambridge

8K's future

Even those interested in spending a lot of money on new-age TV technologies are more likely to investigate features other than 8K, like OLED, HDR support, Micro LED, quantum dots, or even the newer Micro RGB panel tech. Any of those is likely to have a more dramatic impact on home theaters than moving from 4K to 8K.

With the above-mentioned obstacles, many technologists foresaw 8K failing to live up to tech companies' promises. That's not to say that 8K is dead. You can still buy an 8K TV from Samsung, which has 8K TVs with MSRPs starting at $2,500 (for 65 inches), and LG (until stock runs out). With manufacturers refraining from completely ruling out a return to 8K, it's possible that 8K TVs will become relevant for enthusiasts or niche use cases for many years. And there are uses for high-resolution displays outside of TVs, like in head-mounted displays.

However, 8K TV options are shrinking. We're far from the days when companies argued over which had the most "real 8K" TVs. If there is a future where 8K TVs reign, it's one far from today.

Read full article

Comments

A marketing image for 8K TVs that's (still) on LG's US website.

Credit:

A marketing image for 8K TVs that's (still) on LG's US website.

Credit:

Omdia's 2024 data shows demand shifting toward 4K TVs.

Credit:

Omdia

Omdia's 2024 data shows demand shifting toward 4K TVs.

Credit:

Omdia

The University of Cambridge's resolution limit matrix.

Credit:

Computer Laboratory, University of Cambridge

The University of Cambridge's resolution limit matrix.

Credit:

Computer Laboratory, University of Cambridge